irs rejected return ssn already used

This morning I received an email. If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return.

10 Steps To Take If Your Tax Return Is Rejected Gobankingrates

I finally got to do my taxes last night because I was waiting for my W-2 from my previous job a few states away.

. Used freetaxusa to e file and an hr later got a text saying it was rejected coz my SSN has already. Was your tax return rejected because your SSN was already used on another return. Learn how to tackle this issue with information from the experts at HR Block.

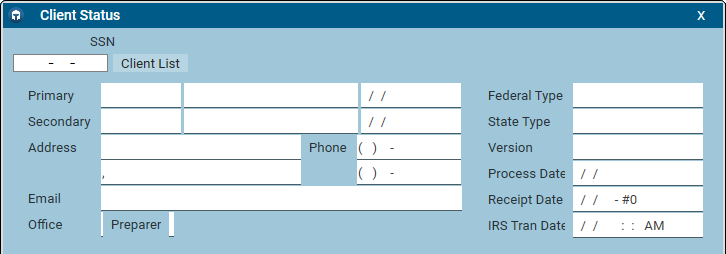

To print your return select the SummaryPrint tab followed by ViewPrint. The second return could be from you or the person who has stolen your information. I called the irs and the guy didnt seem to.

SSN has been used on a previously accepted return. Then wait until the IRS sorts out the. I know I have not filed previously this year.

What is the procedure for Aleck to have the IRS put an indicator on his tax records. File your tax return by mail. The IRS will require you to print your return and paper file this year as you will continue to be rejected via e-file.

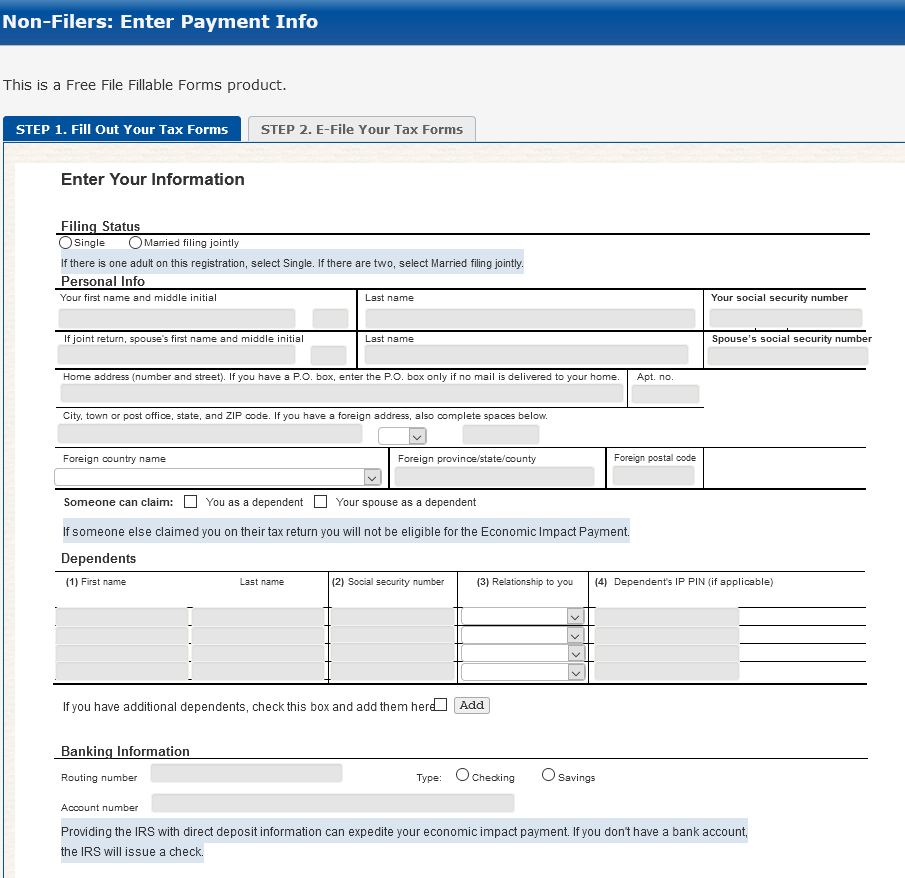

If you used the IRS non-filer site to get a stimulus check you will now get a duplicate SSN rejection. So I used FreeTaxUSA to file and then received an email from FreeTax that my return was rejected because my social security number had already been used to accept a. If the unauthorized use of your SSN was accidental you will need to print sign and mail the paper return to the IRS.

Claiming the Child Tax. We are seeing people who did not notice or ignored the. A Your SSN was Used to file or e-File a Tax Return.

September 23 2020 938 PM. My 1040 was rejected with code R0000-502-001. Tax return rejected dude to SSN already being used - what now.

When the IRS receives two different returns with the same Social Security number the second. The form basically states you think you may have been a victim of ID theft and you are who you say you are and it requires that you submit a copy of your SSN and some form of. Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependents SSN the IRS has security measures in.

Aleck income tax return was rejected IRS reject codes indicated his ssn had already been used. If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return.

Common Irs Error Reject Codes And Suggested Solutions Taxslayer Pro S Blog For Professional Tax Preparers

Fraudulent Tax Return And Identity Theft Prevention Steps

New Irs Site Could Make It Easy For Thieves To Intercept Some Stimulus Payments Krebs On Security

Non Filers Form Initially Rejected R Stimuluscheck

3 Ways To Get A Copy Of Your W 2 From The Irs Wikihow

Wmr And Irs2go Updates And Status Changes Return Received Refund Approved And Refund Sent Aving To Invest

Rejected Tax Return Common Reasons And How To Fix

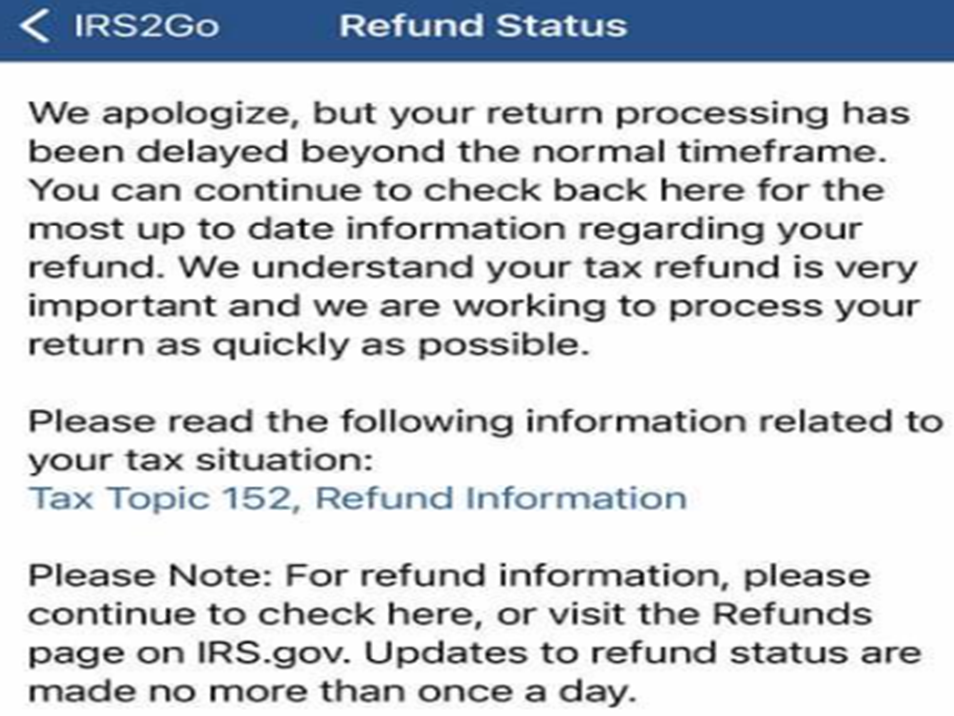

Tax Refund Status Is Still Being Processed

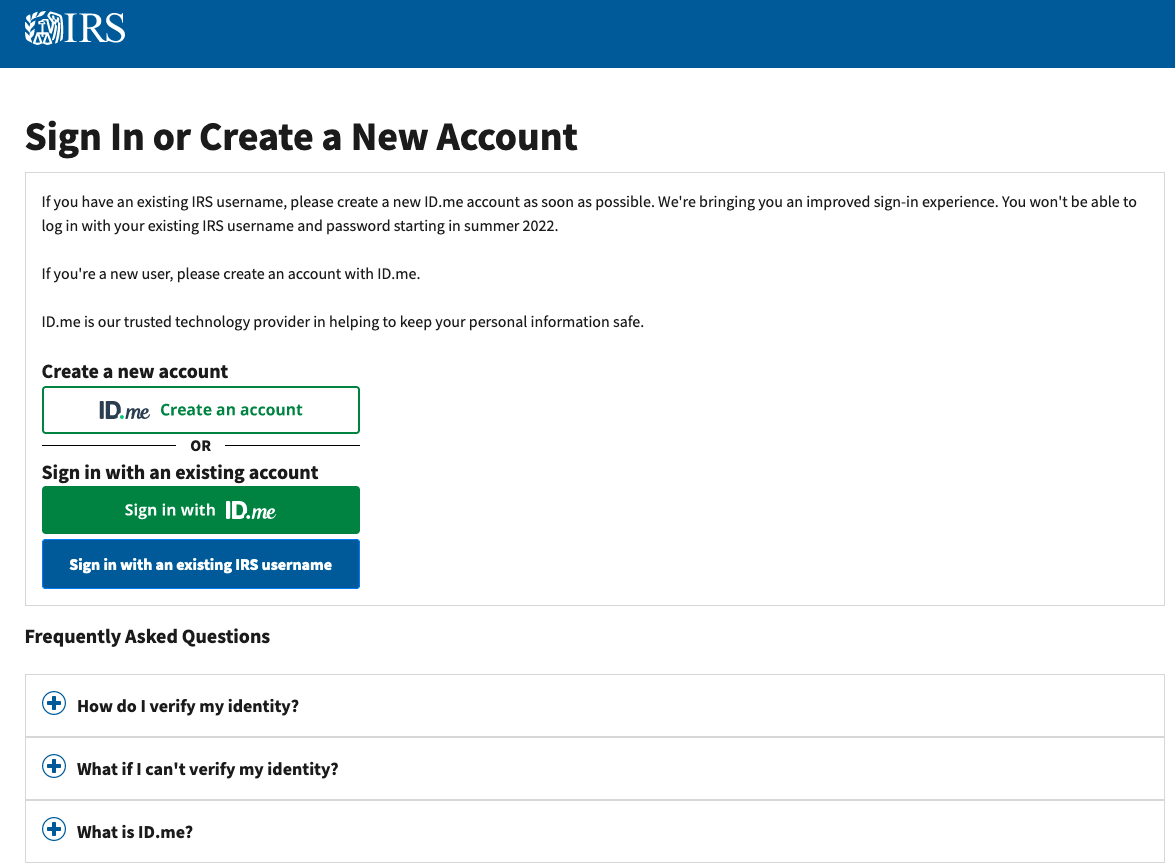

Irs Will Soon Require Selfies For Online Access Krebs On Security

Ssn Already Used By Someone Else On A Tax Return Crossborder Planner

Irs Identity Theft What To Do If Someone Files Taxes Using Your Ssn

What Got Your Tax Return Rejected And What You Can Do About It

Why Would The Irs Reject A Tax Return Tenenbaum Law P C

Irs Notice Cp01h Identity Theft Lock H R Block

Someone Used My Social Security Number To File Taxes What Do I Do

10971 Search Reject Codes From The Irs State And Bank

How Do I Find Out If My Tax Return Is Accepted E File Com